When choosing a cryptocurrency exchange, understanding the fee structure is crucial. For those looking to maximize their profits, selecting a platform with competitive fees is essential. One of the leading exchanges in the crypto world today is MEXC, and understanding MEXC fees can help traders optimize their transactions and minimize costs. In this article, we will explore the different types of fees on MEXC, how they compare to other exchanges, and tips for reducing your trading expenses.

What Is MEXC?

Founded in 2018, MEXC (formerly known as MXC) is a global cryptocurrency exchange that offers spot trading, futures trading, staking, and other financial services. The platform is known for its wide variety of cryptocurrencies and user-friendly interface. MEXC has gained popularity for listing new and trending tokens quickly, making it a go-to exchange for many crypto enthusiasts.

However, before diving into trading, it’s essential to understand the platform’s fee structure. Knowing the ins and outs of MEXC fees can make a significant difference in your overall trading experience.

Types of MEXC Fees

MEXC charges several types of fees that traders need to be aware of. These include:

1. Trading Fees

Trading fees are applied to every buy or sell order placed on the exchange. On MEXC, these fees are divided into two categories:

- Maker Fee: A maker fee is charged when you add liquidity to the order book by placing a limit order below the market price (for a buy order) or above the market price (for a sell order).

- Taker Fee: A taker fee is applied when you remove liquidity from the order book by placing an order that matches an existing one.

The standard MEXC fees for both makers and takers are typically around 0.2% per transaction. However, these rates can vary depending on your trading volume and whether you use the platform’s native token, MX Token (MX), to pay fees.

2. Withdrawal Fees

Withdrawal fees are applied when you transfer your funds from MEXC to an external wallet. The fees vary based on the cryptocurrency you are withdrawing. For example, the withdrawal fee for Bitcoin (BTC) may differ from that of Ethereum (ETH) or other altcoins.

MEXC regularly updates its withdrawal fees to stay competitive, and these fees can be checked directly on their website under the “Fee Schedule” section.

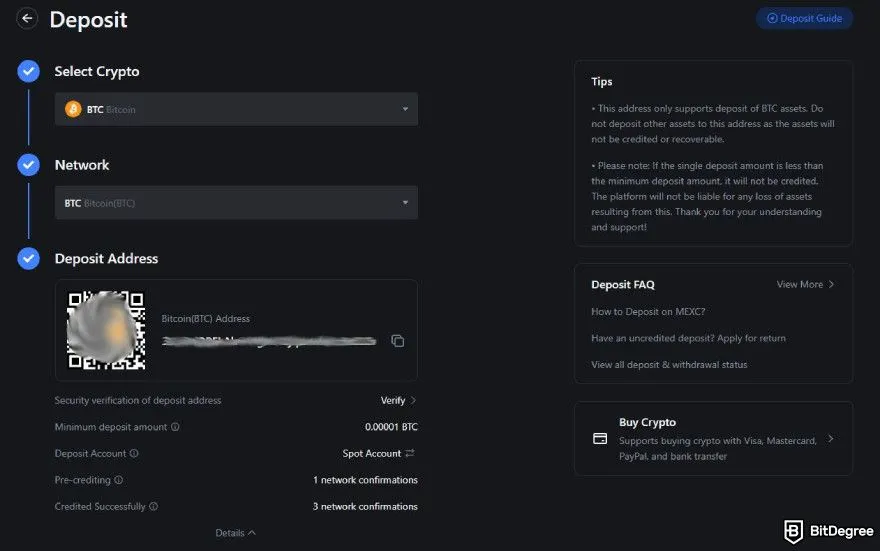

3. Deposit Fees

One advantage of using MEXC is that the platform does not charge any deposit fees. This means you can transfer your crypto assets to the exchange without incurring any additional costs.

4. Futures Trading Fees

For those interested in futures trading, MEXC offers a separate fee structure. The MEXC fees for futures are generally lower than those for spot trading. The platform also provides different fee tiers based on your trading volume.

| Fee Type | Standard Rate |

| Spot Trading Fee | 0.2% |

| Futures Maker Fee | 0.02% |

| Futures Taker Fee | 0.06% |

5. Other Fees

MEXC may also charge other fees for specific services, such as:

- Listing Fees: For projects looking to list their tokens on the exchange.

- API Fees: For developers who use MEXC’s API to automate trading.

How to Reduce MEXC Fees

Reducing trading fees on MEXC can significantly improve your profitability as a trader. Here are some practical tips to minimize your MEXC fees:

1. Use MX Token (MX) to Pay Fees

MEXC offers a discount for traders who use the platform’s native token, MX, to pay their trading fees. By enabling this feature, you can reduce your trading fees by up to 20%. This can be a substantial saving for frequent traders.

2. Increase Your Trading Volume

MEXC has a tiered fee structure that rewards high-volume traders with lower fees. The more you trade, the lower your fees will be. Check the platform’s VIP levels to see the trading volume requirements for each tier.

3. Participate in Fee Promotions

MEXC frequently runs promotions that offer reduced fees for specific trading pairs or activities. Keeping an eye on these promotions can help you save on fees.

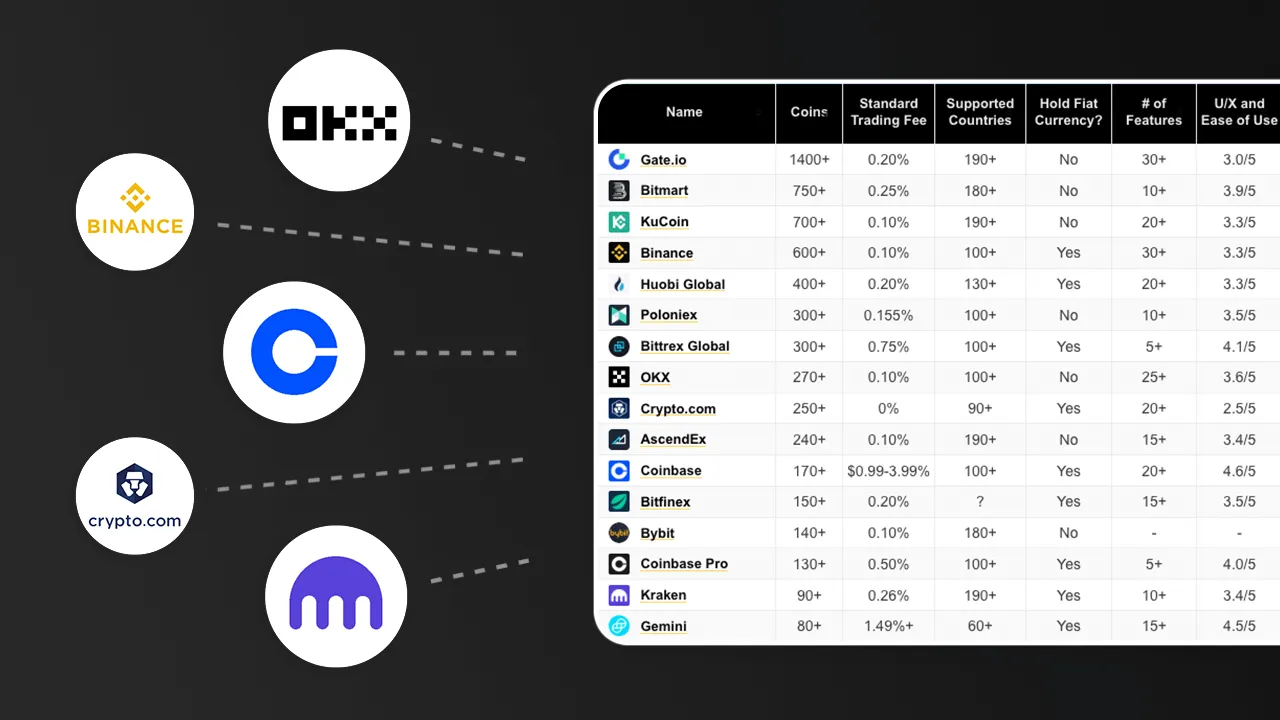

Comparing MEXC Fees with Other Exchanges

How do MEXC fees compare with other popular cryptocurrency exchanges? Let’s take a quick look:

| Exchange | Maker Fee | Taker Fee | Withdrawal Fee |

| MEXC | 0.2% | 0.2% | Varies |

| Binance | 0.1% | 0.1% | Varies |

| KuCoin | 0.1% | 0.1% | Varies |

| Coinbase | 0.5% | 0.5% | Varies |

While MEXC’s fees are slightly higher than some competitors like Binance or KuCoin, the platform makes up for it with its extensive token listings and innovative features. Additionally, using MX Token to pay fees can bring MEXC’s rates closer to those of other leading exchanges.

Why Understanding MEXC Fees Matters

Understanding MEXC fees is crucial for anyone looking to maximize their trading profits. Here are a few reasons why fee awareness is important:

- Cost Management: High fees can eat into your profits, especially if you trade frequently.

- Profitability: Knowing how to reduce fees can significantly improve your profitability over time.

- Strategy Planning: Understanding fees helps you plan your trading strategies more effectively.

Final Thoughts

Whether you are a beginner or an experienced trader, being aware of MEXC fees is essential for successful trading on the platform. By understanding the different types of fees, how they are applied, and ways to reduce them, you can make the most of your trading experience on MEXC.

MEXC continues to be a popular choice for traders due to its wide range of cryptocurrencies, innovative features, and competitive fee structure. By leveraging tips like using the MX Token and increasing your trading volume, you can optimize your transactions and minimize costs. Stay informed, plan your strategies, and make the most of your crypto journey with MEXC.