In the ever-evolving world of cryptocurrency trading, perpetual futures contracts have emerged as a popular tool for traders seeking to maximize their profits. Among the many exchanges offering this feature, MEXC perpetual futures stand out as a powerful option for both beginners and experienced traders. This guide will explore what MEXC perpetual futures are, how they work, and why they are becoming a preferred choice for crypto enthusiasts worldwide.

What Are Perpetual Futures?

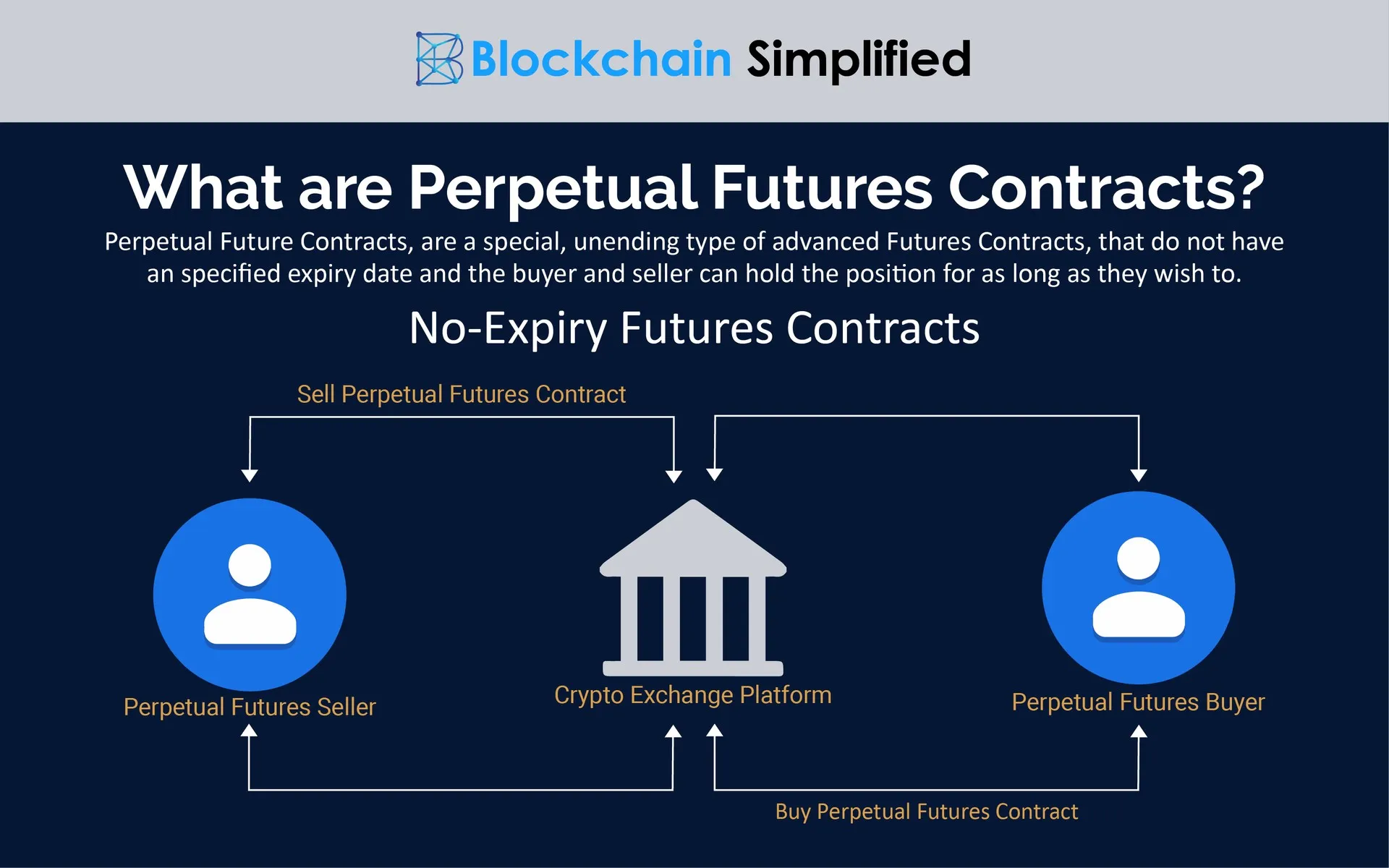

Before diving into the specifics of MEXC perpetual futures, it’s important to understand what perpetual futures contracts are. Unlike traditional futures contracts, which have a set expiration date, perpetual futures do not expire. Traders can hold these contracts indefinitely, allowing them to profit from both rising and falling markets without worrying about settlement dates.

Perpetual futures are particularly attractive to crypto traders due to their flexibility and the ability to use leverage, amplifying potential returns. However, they also come with risks, especially if the market moves against the trader’s position.

Why Choose MEXC for Perpetual Futures?

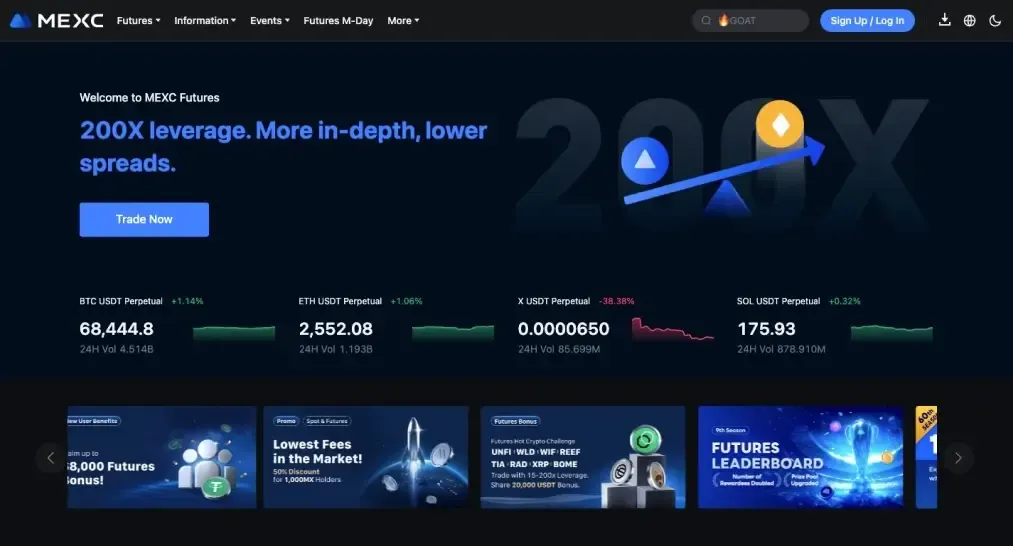

MEXC is one of the leading cryptocurrency exchanges that offers perpetual futures trading. With a user-friendly interface, advanced trading tools, and a wide range of supported cryptocurrencies, MEXC has quickly gained popularity among traders.

Here are some key reasons why MEXC perpetual futures are gaining traction:

1. High Liquidity

MEXC offers high liquidity in its perpetual futures markets, ensuring that traders can execute their orders quickly and at the best possible prices. This is crucial for high-frequency traders and those dealing with large volumes.

2. Wide Range of Trading Pairs

MEXC supports a wide variety of trading pairs in its perpetual futures markets. Whether you’re interested in major cryptocurrencies like Bitcoin and Ethereum or lesser-known altcoins, MEXC has options to suit your trading strategy.

3. Competitive Fees

Trading fees can eat into your profits, especially when engaging in frequent trades. MEXC offers competitive fees for perpetual futures trading, making it an attractive option for traders looking to minimize costs.

4. Leverage Options

One of the biggest advantages of MEXC perpetual futures is the ability to trade with leverage. MEXC allows traders to use leverage of up to 125x on some trading pairs, enabling them to amplify their potential gains. However, it’s essential to use leverage responsibly to avoid significant losses.

How to Trade MEXC Perpetual Futures

Trading MEXC perpetual futures is relatively straightforward. Here’s a step-by-step guide to help you get started:

Step 1: Create an Account on MEXC

If you don’t already have an account, sign up on the MEXC platform. Ensure you complete the KYC (Know Your Customer) process to unlock all trading features.

Step 2: Deposit Funds

Deposit cryptocurrency into your MEXC wallet. You can fund your account with a variety of cryptocurrencies, depending on the trading pair you wish to trade in the perpetual futures market.

Step 3: Navigate to the Perpetual Futures Section

Once your account is funded, navigate to the perpetual futures trading section on the MEXC platform. You will find a list of available trading pairs and their respective leverage options.

Step 4: Place a Trade

Choose your preferred trading pair and decide whether to go long (buy) or short (sell). Set your desired leverage and place your trade. MEXC offers various order types, including market orders, limit orders, and stop-loss orders, to help you manage your trades effectively.

Step 5: Monitor and Manage Your Trades

Keep a close eye on your open positions. Use tools such as stop-loss and take-profit orders to minimize risks and lock in profits.

Benefits of MEXC Perpetual Futures Trading

Trading MEXC perpetual futures comes with several advantages, including:

1. Flexibility

The perpetual nature of these contracts means that you don’t have to worry about expiry dates. You can hold your positions for as long as you want, provided you have sufficient margin to maintain your position.

2. Hedging Opportunities

Perpetual futures can be used to hedge against potential losses in your spot holdings. For instance, if you hold Bitcoin and are worried about a price drop, you can open a short position in Bitcoin perpetual futures to offset potential losses.

3. Profit from Both Bull and Bear Markets

Unlike spot trading, where you can only profit from rising prices, perpetual futures allow you to profit from both bullish and bearish market conditions. This makes them a versatile tool for traders.

Risks Involved in MEXC Perpetual Futures Trading

While MEXC perpetual futures offer significant profit potential, they also come with risks. Some of the key risks include:

1. Liquidation Risk

If the market moves against your position and your margin balance falls below the maintenance margin requirement, your position may be liquidated. This can result in substantial losses.

2. Leverage Risk

Using high leverage can amplify both gains and losses. While leverage can boost your returns, it also increases your risk exposure. It’s crucial to use leverage cautiously and have a solid risk management strategy in place.

3. Market Volatility

The cryptocurrency market is highly volatile. Prices can change dramatically within a short period, making it essential to monitor your trades closely and use appropriate risk management tools.

Tips for Successful MEXC Perpetual Futures Trading

To maximize your success when trading MEXC perpetual futures, consider the following tips:

- Start with a Demo Account: Practice your trading strategies using MEXC’s demo account before risking real funds.

- Use Stop-Loss Orders: Protect your capital by setting stop-loss orders to limit potential losses.

- Diversify Your Trades: Avoid putting all your funds into a single trade. Diversify your positions to spread risk.

- Stay Informed: Keep up with the latest news and market trends to make informed trading decisions.

Conclusion

MEXC perpetual futures offer traders a unique opportunity to profit from the ever-changing cryptocurrency market. With high liquidity, a wide range of trading pairs, and competitive fees, MEXC has established itself as a reliable platform for perpetual futures trading. However, traders should be aware of the risks involved and use appropriate risk management strategies.

By understanding how MEXC perpetual futures work and implementing best practices, traders can maximize their potential profits while minimizing risks. Whether you are a seasoned trader or a beginner, MEXC perpetual futures provide a flexible and powerful tool to navigate the dynamic world of cryptocurrency trading.