Cryptocurrency trading has surged in popularity over the years, and Mexc has established itself as one of the leading platforms in the crypto trading space. For traders who prefer futures trading, understanding the fee structure is essential to maximize profits and minimize costs. This article will delve into the details of Mexc futures fees, providing you with a comprehensive guide to the costs associated with trading on the platform.

What is Mexc?

Mexc is a globally recognized cryptocurrency exchange that offers a wide range of services, including spot trading, futures trading, staking, and more. The platform has gained a reputation for its user-friendly interface, extensive range of supported cryptocurrencies, and robust security features. One of the most popular services on Mexc is futures trading, which allows users to speculate on the price movements of cryptocurrencies without owning the underlying assets.

What are Futures Fees on Mexc?

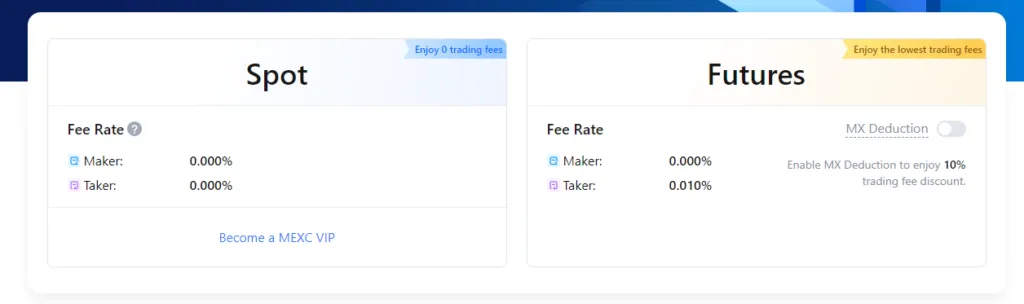

Futures fees are the costs associated with trading futures contracts on the Mexc exchange. These fees are an important consideration for traders, as they can impact overall profitability. The Mexc futures fees structure includes both maker and taker fees, which vary depending on the type of futures contract and the trader’s VIP level.

- Maker Fee: A maker is a trader who adds liquidity to the order book by placing a limit order. Maker fees are generally lower than taker fees.

- Taker Fee: A taker is a trader who removes liquidity from the order book by executing an existing order. Taker fees are usually higher than maker fees.

Understanding the difference between maker and taker fees is crucial for traders aiming to reduce their trading costs on Mexc.

Mexc Futures Fees Structure

Mexc employs a tiered fee structure for futures trading. The fee rates are determined by the trader’s VIP level, which is based on their 30-day trading volume and MX token holdings. Here is a breakdown of the Mexc futures fees:

| VIP Level | 30-Day Trading Volume (USDT) | MX Token Holdings | Maker Fee | Taker Fee |

| VIP 0 | 0 | 0 | 0.02% | 0.06% |

| VIP 1 | ≥ 1,000,000 | ≥ 1,000 | 0.018% | 0.05% |

| VIP 2 | ≥ 5,000,000 | ≥ 5,000 | 0.016% | 0.045% |

| VIP 3 | ≥ 10,000,000 | ≥ 10,000 | 0.014% | 0.04% |

| VIP 4 | ≥ 20,000,000 | ≥ 20,000 | 0.012% | 0.035% |

| VIP 5 | ≥ 50,000,000 | ≥ 50,000 | 0.01% | 0.03% |

As shown in the table, traders who achieve higher VIP levels enjoy lower Mexc futures fees. This incentivizes users to increase their trading activity and hold more MX tokens to reduce their costs.

How to Reduce Mexc Futures Fees

Reducing trading fees can significantly improve a trader’s profitability. Here are some practical tips to minimize your Mexc futures fees:

1. Increase Your Trading Volume

The more you trade on Mexc, the higher your VIP level. By increasing your 30-day trading volume, you can move up the VIP tiers and enjoy lower maker and taker fees.

2. Hold MX Tokens

Holding MX tokens, the native cryptocurrency of the Mexc platform, can help you achieve a higher VIP level. The more MX tokens you hold, the lower your futures trading fees will be.

3. Use Limit Orders

Placing limit orders instead of market orders can help you qualify for the lower maker fee instead of the higher taker fee. Limit orders add liquidity to the order book, which is beneficial for the platform and rewarded with lower fees.

4. Participate in Promotions

Mexc regularly offers promotions and fee discounts for futures traders. Keeping an eye on these promotions can help you take advantage of reduced fees during specific periods.

Comparison with Other Exchanges

When comparing Mexc futures fees with other popular cryptocurrency exchanges, Mexc offers competitive rates. For instance, Binance, a major competitor, charges a taker fee of 0.04% for futures trading at the basic level, which is slightly lower than Mexc’s VIP 0 taker fee. However, Mexc’s VIP program provides significant fee reductions for active traders.

Here’s a quick comparison of futures fees between Mexc, Binance, and Bybit:

| Exchange | Maker Fee | Taker Fee |

| Mexc | 0.02% | 0.06% |

| Binance | 0.02% | 0.04% |

| Bybit | 0.01% | 0.03% |

While Binance may offer slightly lower fees for beginners, Mexc provides more attractive rates for traders who reach higher VIP levels.

Hidden Costs to Consider

In addition to maker and taker fees, traders should be aware of other potential costs associated with futures trading on Mexc:

- Funding Fees: These are periodic payments made between long and short positions. The funding fee rate varies based on market conditions.

- Withdrawal Fees: While these do not directly impact futures trading, withdrawal fees can affect your overall trading costs.

Why Choose Mexc for Futures Trading?

Mexc offers several advantages for futures traders:

- Wide Range of Futures Contracts: Mexc supports a variety of cryptocurrency futures contracts, providing ample trading opportunities.

- User-Friendly Interface: The platform is easy to navigate, even for beginners.

- Competitive Fee Structure: Mexc futures fees are competitive, especially for traders who reach higher VIP levels.

- Robust Security Features: Mexc prioritizes the security of users’ funds and personal information.

Final Thoughts

Understanding Mexc futures fees is crucial for any trader looking to maximize their profits on the platform. By familiarizing yourself with the fee structure and implementing strategies to reduce your fees, you can enhance your trading experience and improve your overall profitability.

Whether you’re a beginner or an experienced trader, Mexc offers a competitive and user-friendly platform for futures trading. By optimizing your trading activity and taking advantage of the VIP program, you can minimize your Mexc futures fees and maximize your returns in the ever-evolving world of cryptocurrency trading.

In conclusion, if you’re planning to dive into futures trading on Mexc, take the time to understand the fees, leverage promotions, and aim for higher VIP levels to enjoy lower costs. Mexc futures fees might seem like a small aspect at first glance, but they play a significant role in determining your success as a trader.