In the rapidly evolving world of cryptocurrency trading, choosing the right exchange platform is crucial. One of the most popular exchanges is MEXC, known for its user-friendly interface, a wide variety of digital assets, and competitive fees. However, a common question among traders is: “Do you need KYC for MEXC?” This article will explore everything you need to know about MEXC’s KYC (Know Your Customer) requirements and how it affects your trading experience.

What is MEXC?

MEXC is a global cryptocurrency exchange platform that allows users to trade a variety of digital assets, including Bitcoin, Ethereum, and altcoins. Established in 2018, MEXC has grown to become one of the top platforms in the crypto industry, providing services to millions of users worldwide. The platform offers features such as spot trading, futures, staking, and more.

One of the reasons for MEXC’s popularity is its relatively lenient KYC requirements compared to other exchanges. But do you need KYC for MEXC to trade and use its services? Let’s dive deeper.

What is KYC and Why is It Important?

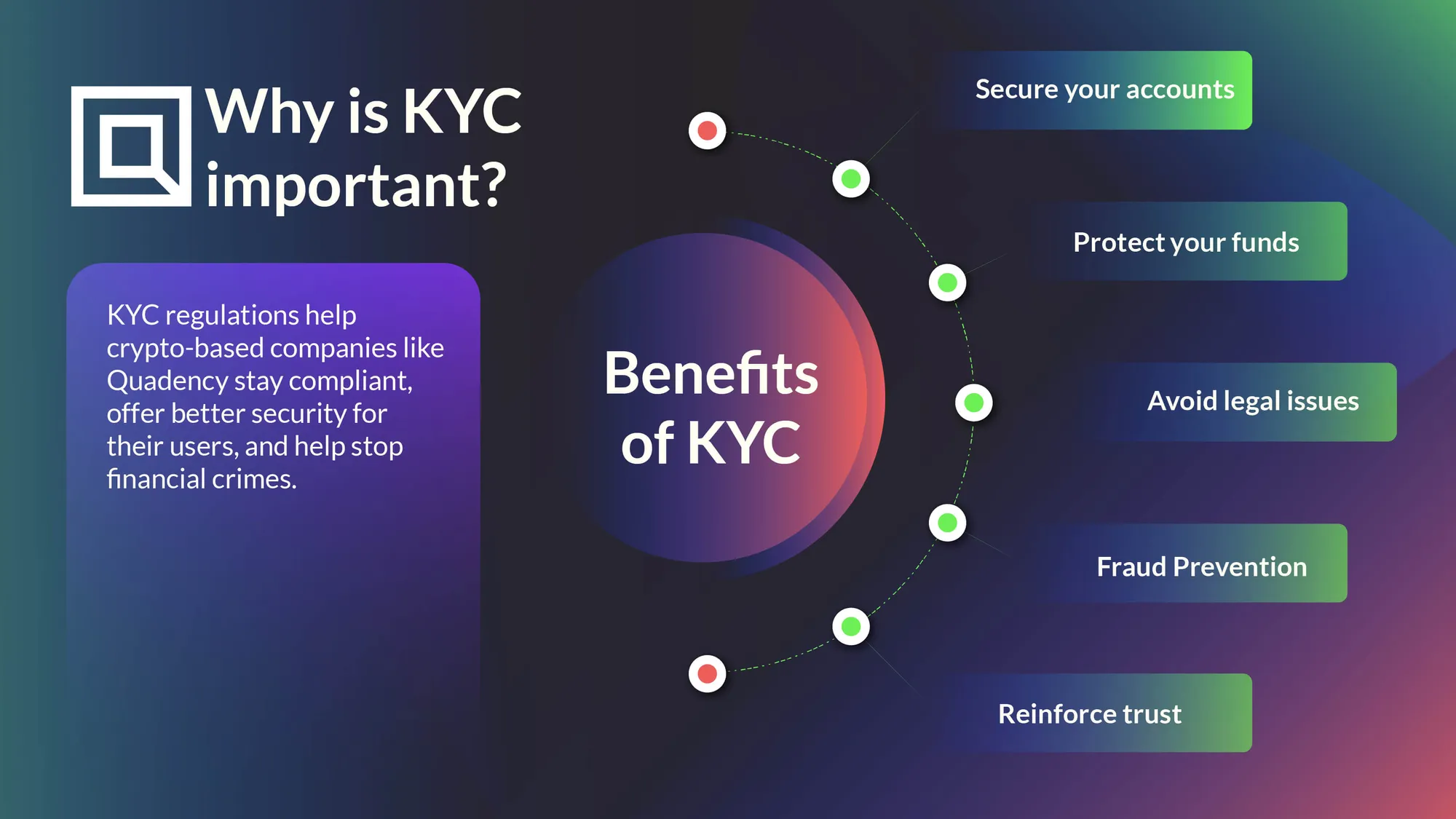

KYC (Know Your Customer) is a verification process used by financial institutions and cryptocurrency exchanges to confirm the identity of their users. KYC processes typically involve providing personal information such as a government-issued ID, proof of address, and sometimes a selfie for identity verification.

The purpose of KYC is to ensure that the platform complies with anti-money laundering (AML) regulations and to protect users from fraudulent activities. While some exchanges make KYC mandatory for all users, others allow limited functionality for users who prefer to remain anonymous.

So, do you need KYC for MEXC? The answer depends on how you plan to use the platform.

Do You Need KYC for MEXC? The Short Answer

The good news for crypto enthusiasts is that MEXC does not require KYC for most of its services. You can create an account, deposit funds, and start trading without completing the KYC process. This makes MEXC an attractive option for users who value privacy and want to maintain anonymity.

However, there are certain situations where completing the KYC process may be necessary. For example, if you wish to withdraw larger amounts of funds or access specific services, MEXC may require you to complete KYC verification.

Benefits of Using MEXC Without KYC

One of the biggest advantages of MEXC is its flexibility regarding KYC requirements. Here are some benefits of using MEXC without KYC:

- Anonymity: Users can trade cryptocurrencies without revealing their personal information.

- Quick Sign-Up Process: Creating an account is fast and straightforward, as there’s no need for lengthy verification procedures.

- Access to a Wide Range of Assets: Even without KYC, users can trade a variety of cryptocurrencies and tokens on MEXC.

- Lower Barrier to Entry: Users from countries with strict financial regulations can still access crypto trading without restrictions.

But before you decide to skip KYC altogether, it’s essential to understand the potential limitations.

Limitations of Not Completing KYC on MEXC

While MEXC offers many features without requiring KYC, there are some limitations for non-KYC users. Here are a few important points to consider:

- Withdrawal Limits:

- Non-KYC users on MEXC have a daily withdrawal limit of up to 20 BTC. If you need to withdraw more than this amount, you will be required to complete the KYC process.

- Access to Certain Features:

- Some advanced features, such as futures trading and higher leverage options, may require KYC verification.

- Security Measures:

- Completing KYC adds an extra layer of security to your account. If your account is compromised, having your identity verified can help recover your funds more easily.

How to Complete the KYC Process on MEXC

If you decide to complete the KYC verification on MEXC, the process is simple and straightforward. Here’s a step-by-step guide:

- Log in to Your MEXC Account

- Visit the official MEXC website and log in to your account.

- Go to the KYC Section

- Navigate to the “Account Security” section and select “Identity Verification.”

- Provide Your Information

- Submit your personal details, including your name, date of birth, and country of residence.

- Upload Documents

- Upload a government-issued ID (passport, driver’s license, or national ID) and proof of address.

- Complete the Verification Process

- Follow the instructions to complete the verification. This may include taking a selfie or completing a face verification process.

Once you’ve submitted your documents, the MEXC team will review your application. Verification usually takes a few hours to a few days.

Why Consider Completing KYC on MEXC?

While MEXC allows users to trade without KYC, there are several benefits to completing the KYC process:

- Higher Withdrawal Limits: KYC-verified users can enjoy higher withdrawal limits, making it easier to access their funds.

- Access to Advanced Features: Some features, such as higher leverage and futures trading, may be restricted for non-KYC users.

- Improved Security: KYC verification adds an extra layer of security, protecting your account from unauthorized access.

Is MEXC Safe Without KYC?

Many users wonder whether trading on MEXC without KYC is safe. The platform employs robust security measures, including two-factor authentication (2FA), cold storage of funds, and regular security audits.

However, completing KYC provides an additional layer of protection. In case of any disputes or security breaches, having your identity verified can make it easier to resolve issues with the platform.

Conclusion

So, do you need KYC for MEXC? The answer depends on your trading needs. For most users, MEXC offers a seamless trading experience without requiring KYC. You can sign up, deposit funds, and start trading without going through a lengthy verification process. However, if you need higher withdrawal limits or want to access advanced features, completing the KYC process is recommended.

Whether you choose to complete KYC or not, MEXC remains a top choice for cryptocurrency traders worldwide. Its user-friendly platform, wide range of assets, and flexible KYC requirements make it an excellent option for both beginners and experienced traders.

In conclusion, do you need KYC for MEXC? No, you don’t need it for most activities, but it’s worth considering if you plan to withdraw large amounts or use advanced trading features. Ultimately, the decision to complete KYC depends on your trading preferences and security needs.