Cryptocurrency trading has grown immensely in recent years, and platforms like MEXC are at the forefront of this revolution. Known for its diverse range of cryptocurrencies and user-friendly interface, MEXC is a go-to platform for both beginners and seasoned traders. However, understanding the MEXC trading fees is essential for maximizing your profits and minimizing costs. In this article, we will break down everything you need to know about MEXC trading fees in 2025, including deposit fees, withdrawal fees, and trading fees.

What Are MEXC Trading Fees?

Trading fees are charges applied by cryptocurrency exchanges when users buy or sell digital assets. On MEXC, these fees are generally categorized into two types:

- Maker Fees: These are fees applied to users who add liquidity to the order book by placing limit orders.

- Taker Fees: These are fees applied to users who remove liquidity from the order book by executing existing orders.

Understanding the structure of MEXC trading fees can help you choose the best trading strategy to reduce costs and increase profitability.

Overview of MEXC Trading Fees

The MEXC platform offers competitive trading fees compared to other exchanges. Here’s a quick breakdown:

- Spot Trading Fees: 0.2% for both makers and takers.

- Futures Trading Fees: 0.02% for makers and 0.06% for takers.

- Deposit Fees: Free.

- Withdrawal Fees: Vary depending on the cryptocurrency.

MEXC also provides discounts on trading fees for users who hold and use the platform’s native token, MX Token. By holding MX tokens, users can reduce their MEXC trading fees significantly.

How to Reduce MEXC Trading Fees

Reducing your MEXC trading fees is crucial for optimizing your trading strategy. Here are some effective ways to lower your fees on MEXC:

1. Use MX Tokens

MEXC offers discounts to users who pay their trading fees using MX tokens. By holding a certain amount of MX tokens in your account, you can enjoy reduced trading fees across the platform. For example:

- Spot Trading Fee Discount: Up to 25% off.

- Futures Trading Fee Discount: Up to 10% off.

2. Increase Your Trading Volume

Another way to reduce your MEXC trading fees is by increasing your trading volume. MEXC offers tiered discounts based on your 30-day trading volume. The higher your volume, the lower your fees will be.

3. Participate in Promotions

MEXC frequently runs promotions that offer reduced or zero trading fees for specific pairs or trading activities. Keep an eye on these promotions to take advantage of fee reductions.

Spot Trading Fees on MEXC

Spot trading involves buying and selling cryptocurrencies at the current market price. The MEXC trading fees for spot trading are:

- Maker Fee: 0.2%

- Taker Fee: 0.2%

By using MX tokens to pay fees, you can reduce these fees to as low as 0.15%.

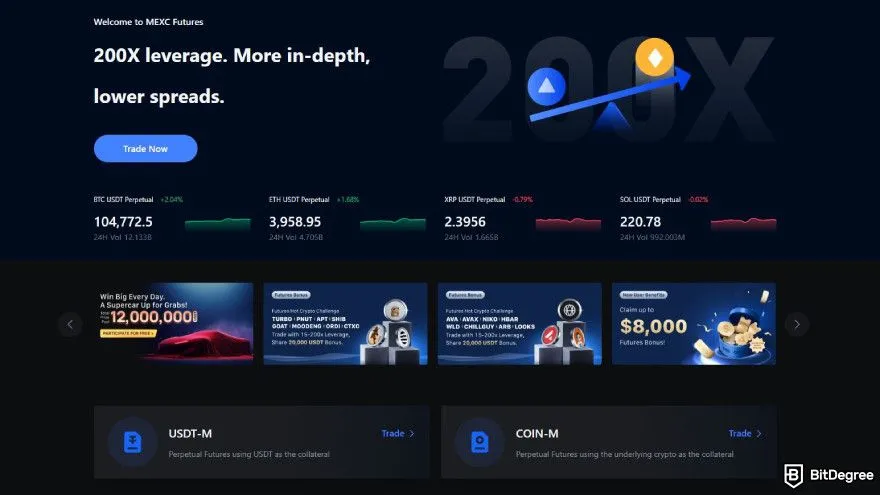

Futures Trading Fees on MEXC

Futures trading allows traders to speculate on the future price of cryptocurrencies. The MEXC trading fees for futures trading are lower than spot trading fees:

- Maker Fee: 0.02%

- Taker Fee: 0.06%

Holding MX tokens can further reduce these fees.

Deposit and Withdrawal Fees on MEXC

MEXC does not charge any deposit fees, making it an attractive option for traders looking to fund their accounts without additional costs. However, withdrawal fees vary based on the cryptocurrency being withdrawn. Here are some examples:

- Bitcoin (BTC): 0.0005 BTC per withdrawal.

- Ethereum (ETH): 0.005 ETH per withdrawal.

- USDT (ERC-20): 10 USDT per withdrawal.

It is essential to check the updated withdrawal fees on the MEXC website as they may change based on network conditions.

Why Are MEXC Trading Fees Important?

Understanding MEXC trading fees is vital for several reasons:

- Cost Management: Trading fees can eat into your profits, especially if you’re a frequent trader. Reducing these fees can significantly boost your overall returns.

- Trading Strategy: Different trading strategies may incur different fees. For example, high-frequency trading strategies can be costly if the fees are not optimized.

- Long-Term Savings: Over time, lower fees can result in significant savings, especially for traders with high trading volumes.

Comparing MEXC Trading Fees with Other Exchanges

When compared to other popular exchanges like Binance, Coinbase, and Kraken, MEXC offers competitive fees. Here’s a quick comparison:

| Exchange | Spot Trading Fees (Maker/Taker) | Futures Trading Fees (Maker/Taker) |

| MEXC | 0.2% / 0.2% | 0.02% / 0.06% |

| Binance | 0.1% / 0.1% | 0.02% / 0.04% |

| Coinbase | 0.5% / 0.5% | N/A |

| Kraken | 0.26% / 0.26% | 0.02% / 0.05% |

While MEXC’s spot trading fees are slightly higher than Binance, the platform offers competitive futures trading fees and various ways to reduce costs.

Tips for Managing MEXC Trading Fees Effectively

- Always Use MX Tokens: Ensure you have enough MX tokens in your account to take advantage of fee discounts.

- Monitor Your Trading Volume: Regularly check your 30-day trading volume to see if you qualify for lower fees.

- Stay Updated on Promotions: Participate in MEXC’s promotions to reduce or eliminate trading fees for specific pairs.

Conclusion

Understanding and managing your MEXC trading fees is essential for optimizing your cryptocurrency trading experience. By using MX tokens, increasing your trading volume, and taking advantage of promotions, you can significantly reduce your costs on the platform. MEXC remains one of the top choices for traders due to its competitive fees, wide range of cryptocurrencies, and user-friendly features. Whether you’re a beginner or an experienced trader, paying attention to your MEXC trading fees will help you maximize your profits and improve your overall trading strategy.