MEXC Global has established itself as one of the leading cryptocurrency exchanges globally. The platform offers a variety of trading products, including spot trading, margin trading, and most notably, futures trading. In this article, we’ll dive deep into the MEXC Futures List, explaining what it is, how to use it, and why it matters to traders worldwide.

What is the MEXC Futures List?

The MEXC Futures List refers to the collection of perpetual contracts and futures trading pairs available on the MEXC Global exchange. Futures trading on MEXC allows traders to speculate on the price movements of various cryptocurrencies without actually owning the underlying assets. The list includes popular cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and many altcoins that are not available on other exchanges.

MEXC is known for regularly updating its futures list to include new, trending cryptocurrencies. This dynamic approach makes it one of the most comprehensive futures offerings in the crypto space.

Why is the MEXC Futures List Important?

For traders, having access to a diverse range of futures contracts is crucial. The MEXC Futures List provides exactly that, giving users the opportunity to trade a wide variety of cryptocurrencies with leverage. Here are some reasons why the MEXC futures list stands out:

- Wide Selection of Cryptocurrencies: MEXC offers futures contracts for both major cryptocurrencies and lesser-known altcoins. This variety allows traders to diversify their portfolios and take advantage of niche market movements.

- High Leverage Options: The MEXC futures list supports leverage trading, allowing users to amplify their positions. Traders can choose from various leverage levels, ranging from 1x to 200x, depending on the specific contract.

- 24/7 Trading: The crypto market never sleeps, and neither does MEXC. The futures list is accessible 24/7, enabling traders to take advantage of market opportunities at any time.

- Low Fees: MEXC is known for its competitive fee structure. Futures traders benefit from low transaction fees, which can significantly impact profitability, especially for high-frequency traders.

How to Access the MEXC Futures List

To start trading futures on MEXC, you need to know how to access the MEXC Futures List and navigate the platform effectively. Here’s a step-by-step guide:

- Sign Up for an Account: If you don’t already have a MEXC account, visit their website and sign up. The registration process is straightforward and requires only basic information.

- Verify Your Identity: To unlock the full features of the exchange, including futures trading, you’ll need to complete the KYC (Know Your Customer) process.

- Deposit Funds: Once your account is verified, deposit funds into your MEXC wallet. You can fund your account with cryptocurrencies or fiat currencies, depending on your preferences.

- Navigate to the Futures Section: On the MEXC homepage, click on the ‘Futures’ tab to access the MEXC Futures List. Here, you’ll find all available futures contracts along with their respective leverage options.

- Choose a Contract: Browse through the futures list and select a contract that aligns with your trading strategy. Each contract will display essential details such as price, leverage, and funding rate.

Popular Contracts on the MEXC Futures List

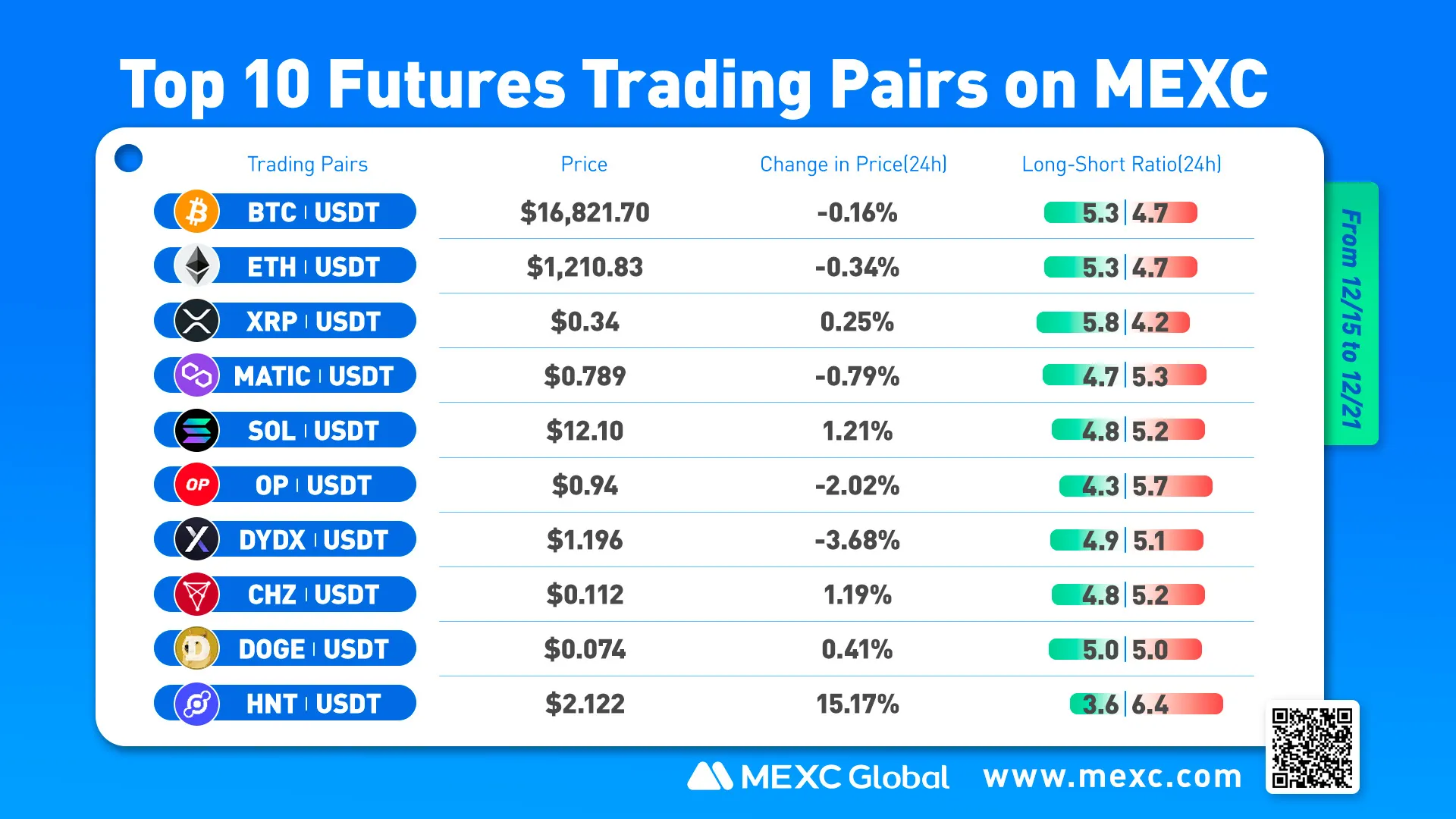

The MEXC Futures List is extensive, but some contracts are more popular among traders due to their liquidity and trading volume. Here are a few noteworthy futures contracts available on MEXC:

- BTC/USDT Perpetual: Bitcoin remains the most traded cryptocurrency on MEXC’s futures list. The BTC/USDT perpetual contract allows traders to speculate on Bitcoin’s price with up to 200x leverage.

- ETH/USDT Perpetual: Ethereum’s popularity continues to grow, and the ETH/USDT contract on MEXC is one of the most traded pairs. Traders can take advantage of Ethereum’s price movements with high leverage options.

- SHIB/USDT Perpetual: MEXC is known for listing trending altcoins, and the SHIB/USDT perpetual contract is a favorite among meme coin enthusiasts.

- SOL/USDT Perpetual: Solana’s rapid rise in the crypto market has made its perpetual contract highly sought after on the MEXC Futures List.

Tips for Trading on the MEXC Futures List

Trading futures can be profitable, but it also comes with risks. Here are some tips to help you succeed when trading on the MEXC Futures List:

- Understand Leverage: While leverage can amplify your gains, it also increases your risk. Start with lower leverage if you’re new to futures trading.

- Manage Risk: Always use stop-loss orders to protect your capital. Futures trading is highly volatile, and having a risk management strategy is crucial.

- Stay Updated: The MEXC Futures List is constantly updated with new contracts. Keep an eye on the latest listings to stay ahead of market trends.

- Use Technical Analysis: Successful futures trading requires a solid understanding of technical analysis. Use tools like moving averages, RSI, and MACD to make informed trading decisions.

Advantages of Trading on MEXC

Besides the extensive MEXC Futures List, the platform offers several advantages for traders:

- User-Friendly Interface: The MEXC platform is designed to be intuitive and easy to navigate, even for beginners.

- Mobile App: MEXC offers a mobile app, allowing traders to manage their futures positions on the go.

- Security: MEXC takes security seriously, employing various measures to protect users’ funds and personal information.

Conclusion

The MEXC Futures List is an essential tool for traders looking to explore the world of futures trading. With its extensive selection of contracts, high leverage options, and user-friendly platform, MEXC Global is an excellent choice for both beginner and experienced traders.

If you’re looking to maximize your trading potential, understanding the MEXC Futures List and how to use it effectively is crucial. Stay informed, manage your risks, and take advantage of the diverse futures contracts available on MEXC to make the most of your trading journey.