Cryptocurrency trading has gained significant popularity in the USA, and MEXC has emerged as one of the leading platforms facilitating this trend. With the increasing focus on regulatory compliance, one of the most important aspects for traders is understanding the MEXC KYC process. In this comprehensive guide, we’ll cover everything you need to know about MEXC KYC USA, why it’s essential, how it works, and how you can complete it smoothly.

What is MEXC?

MEXC is a globally recognized cryptocurrency exchange that has made significant inroads in the USA. The platform offers a wide range of services, including spot trading, futures, staking, and more. One of the reasons behind MEXC’s growing popularity is its user-friendly interface, high liquidity, and a wide array of cryptocurrencies available for trading.

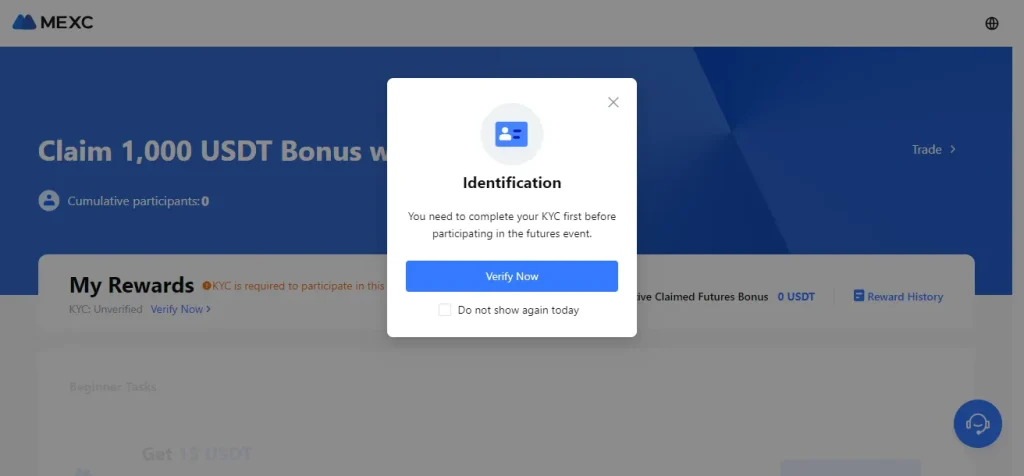

However, to fully utilize MEXC’s services in the USA, users must complete the KYC (Know Your Customer) process. This process ensures that the platform complies with regulatory requirements and protects users from potential fraud and illegal activities.

Understanding MEXC KYC USA

MEXC KYC USA refers to the specific Know Your Customer procedures that users in the USA need to complete to trade on the platform. This process involves verifying a user’s identity to comply with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations. Completing the MEXC KYC USA process is essential to access the platform’s full range of features.

Why is KYC Important for MEXC Users in the USA?

The MEXC KYC process in the USA is crucial for several reasons:

- Compliance with Regulations: The USA has strict regulations regarding cryptocurrency exchanges to prevent money laundering and illegal activities. MEXC must adhere to these regulations, making KYC mandatory.

- Enhanced Security: KYC verification adds an additional layer of security to your account. By verifying your identity, MEXC ensures that only authorized users can access the platform.

- Access to Full Features: Without completing the MEXC KYC USA process, users may have limited access to the platform’s features. Completing the verification process allows users to enjoy higher withdrawal limits and access to advanced trading options.

- Fraud Prevention: KYC helps prevent fraudulent activities by ensuring that users are genuine and that the platform is not being used for illicit purposes.

How to Complete MEXC KYC USA

The MEXC KYC process for USA users is straightforward. Follow these steps to complete your verification:

Step 1: Create an Account on MEXC

If you haven’t already, visit the official MEXC website and create an account. Ensure you provide accurate information during the registration process.

Step 2: Log in to Your Account

Once your account is created, log in using your credentials. Navigate to the “Account” section and click on “KYC Verification.”

Step 3: Provide Personal Information

You will be required to provide personal details such as your full name, date of birth, address, and nationality. Ensure all information matches the details on your government-issued ID.

Step 4: Upload Documents

To verify your identity, you’ll need to upload the following documents:

- A government-issued ID (passport, driver’s license, or ID card)

- A proof of address document (utility bill, bank statement, or lease agreement)

Step 5: Facial Recognition

MEXC may also require you to complete a facial recognition process to ensure that the documents you provide match your identity.

Step 6: Wait for Verification

Once you’ve submitted all the required documents, MEXC will review your application. The verification process typically takes a few hours to a few days. You will receive a notification once your KYC is approved.

Common Issues and How to Resolve Them

While the MEXC KYC USA process is generally smooth, some users may encounter issues. Here are some common problems and how to fix them:

- Document Rejection: Ensure that the documents you upload are clear, not expired, and match the information you provided.

- Incomplete Information: Double-check that all required fields are filled out accurately. Any discrepancies can cause delays.

- Facial Recognition Issues: Make sure you are in a well-lit environment and that your camera is functioning properly.

Benefits of Completing MEXC KYC USA

Completing the MEXC KYC USA process provides several benefits:

- Higher Withdrawal Limits: Verified users can enjoy higher withdrawal limits compared to non-verified users.

- Access to Advanced Features: Some features, such as futures trading and staking, may require KYC verification.

- Enhanced Security: Protect your account from unauthorized access by verifying your identity.

- Regulatory Compliance: Stay on the right side of the law by complying with the USA’s cryptocurrency regulations.

Is MEXC KYC USA Mandatory?

Yes, completing the MEXC KYC USA process is mandatory for users who wish to access the platform’s full range of features. Non-verified users may face restrictions, including lower withdrawal limits and limited access to certain trading options.

Tips for a Smooth MEXC KYC USA Process

Here are some tips to ensure your MEXC KYC verification goes smoothly:

- Use High-Quality Scans: Ensure your documents are clear and legible.

- Provide Accurate Information: Double-check all the information you provide to avoid discrepancies.

- Be Patient: The verification process may take some time, so be patient while MEXC reviews your application.

- Follow Instructions Carefully: Ensure you follow all the instructions provided during the KYC process.

Conclusion

MEXC KYC USA is an essential process for any trader looking to utilize the full features of the MEXC cryptocurrency exchange. By understanding the KYC requirements, providing accurate information, and following the verification steps, you can ensure a seamless experience on the platform.

Completing the MEXC KYC USA process not only enhances your security but also ensures that you remain compliant with regulatory requirements in the USA. Whether you’re a seasoned trader or a newcomer to the crypto space, following this guide will help you navigate the KYC process with ease. So, get started today and unlock the full potential of MEXC!