In the world of cryptocurrency trading, security and compliance are key factors that both platforms and users must adhere to. One of the most significant aspects of compliance in crypto exchanges is the Know Your Customer (KYC) process. For traders looking to use MEXC, a leading cryptocurrency exchange, understanding the MEXC KYC requirements is essential for a seamless trading experience.

In this comprehensive guide, we will delve into the details of MEXC KYC requirements, why they are important, how to complete the verification process, and tips to ensure your account remains secure.

What Is MEXC?

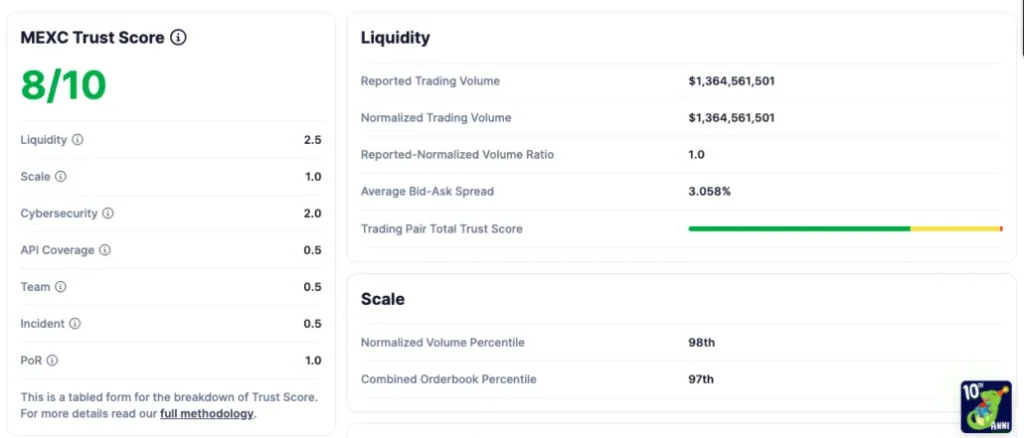

MEXC is a popular cryptocurrency exchange platform that offers users a wide variety of digital assets to trade, including Bitcoin, Ethereum, and many altcoins. The platform is known for its user-friendly interface, robust security measures, and a wide range of trading features such as spot trading, futures trading, and staking.

To ensure compliance with international regulations and enhance the security of its platform, MEXC requires users to complete a KYC (Know Your Customer) verification process. This process helps to verify the identity of users and prevent illegal activities such as money laundering and fraud.

Why Are KYC Requirements Important on MEXC?

KYC requirements are a critical part of maintaining the integrity and security of any cryptocurrency exchange. Here’s why MEXC KYC requirements are essential:

- Compliance with Regulations: MEXC operates globally and must adhere to various regulatory frameworks in different countries. KYC helps the exchange comply with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations.

- Enhanced Security: By verifying user identities, MEXC ensures that the platform remains secure from fraudulent activities. This also helps in protecting user funds.

- Building Trust: Completing KYC verification enhances trust between users and the platform, making it more appealing to serious traders and investors.

- Withdrawal Limits: Users who complete the KYC process on MEXC enjoy higher withdrawal limits compared to unverified users.

MEXC KYC Requirements: A Step-by-Step Guide

To start trading on MEXC without limitations, you need to complete the KYC verification process. Here’s how to do it:

Step 1: Register on MEXC

Before you can complete the KYC process, you must have an account on MEXC. To register:

- Visit the official MEXC website.

- Click on the “Sign Up” button.

- Enter your email or phone number and create a password.

- Verify your email or phone number.

Once your account is created, you can proceed with the KYC process.

Step 2: Access the KYC Verification Page

- Log in to your MEXC account.

- Go to your account dashboard.

- Click on the “Identity Verification” or “KYC” tab.

Step 3: Submit Your Personal Information

MEXC KYC requirements involve submitting your personal details, including:

- Full Name (as it appears on your ID)

- Date of Birth

- Country of Residence

- ID Type (Passport, National ID, or Driver’s License)

Ensure that the information you provide matches the details on your ID documents.

Step 4: Upload Required Documents

You will need to upload clear photos of your ID documents. The accepted ID types include:

- Passport

- National ID card

- Driver’s license

Make sure that the photos are clear, and all details are visible. Blurry or cropped images may result in delays or rejection.

Step 5: Complete Face Verification

MEXC also requires users to complete a face verification process. This is typically done through the MEXC app, where you will need to:

- Allow camera access.

- Follow the on-screen instructions to capture your facial image.

This step ensures that the person completing the KYC process is the same individual shown in the ID documents.

Step 6: Wait for Approval

After submitting your documents and completing the face verification, you need to wait for MEXC to review your application. This process usually takes a few hours to a few days.

You will receive an email notification once your verification is complete.

Common Issues and How to Avoid Them

While the MEXC KYC process is straightforward, users may encounter some common issues during verification. Here are some tips to avoid them:

- Ensure Your Documents Are Clear: Upload high-quality images of your ID documents. Blurry or unclear images can result in rejection.

- Use Matching Information: Make sure the information you enter matches your ID documents exactly.

- Complete Face Verification Properly: Follow the instructions carefully during the face verification process to avoid errors.

- Check for Notifications: Keep an eye on your email for any updates or requests from MEXC regarding your KYC application.

Benefits of Completing MEXC KYC Requirements

Completing the MEXC KYC requirements offers several benefits to users, including:

- Higher Withdrawal Limits: Verified users can withdraw larger amounts of cryptocurrency compared to unverified users.

- Access to All Features: Some features on MEXC, such as futures trading and staking, may be restricted for unverified users.

- Increased Security: KYC verification adds an extra layer of security to your account.

- Compliance: By completing KYC, you ensure that your account complies with global regulations, reducing the risk of account suspension.

FAQs About MEXC KYC Requirements

- Is KYC mandatory on MEXC? Yes, completing the KYC process is necessary to access all features on MEXC and enjoy higher withdrawal limits.

- How long does the MEXC KYC process take? The verification process typically takes a few hours to a few days, depending on the volume of applications.

- Can I trade on MEXC without KYC? While you can create an account and trade without completing KYC, your account will have limitations, such as lower withdrawal limits.

- What happens if my KYC application is rejected? If your application is rejected, you can reapply by correcting any issues and submitting the required documents again.

Conclusion

Understanding and completing the MEXC KYC requirements is crucial for traders who want to maximize their experience on the platform. By following the step-by-step guide provided in this article, users can ensure a smooth verification process and unlock all the features MEXC has to offer.

Completing your KYC not only enhances your account security but also ensures compliance with global regulations. So, take the time to verify your account and enjoy a secure and seamless trading experience on MEXC.