In the world of cryptocurrency trading, knowing whether an exchange requires Know Your Customer (KYC) verification is essential. MEXC, one of the most popular crypto exchanges, has gained significant traction among traders worldwide due to its user-friendly interface, wide range of supported cryptocurrencies, and minimal restrictions. But one key question remains: does MEXC require KYC? In this article, we will explore the MEXC KYC policy, its pros and cons, and how it compares to other exchanges.

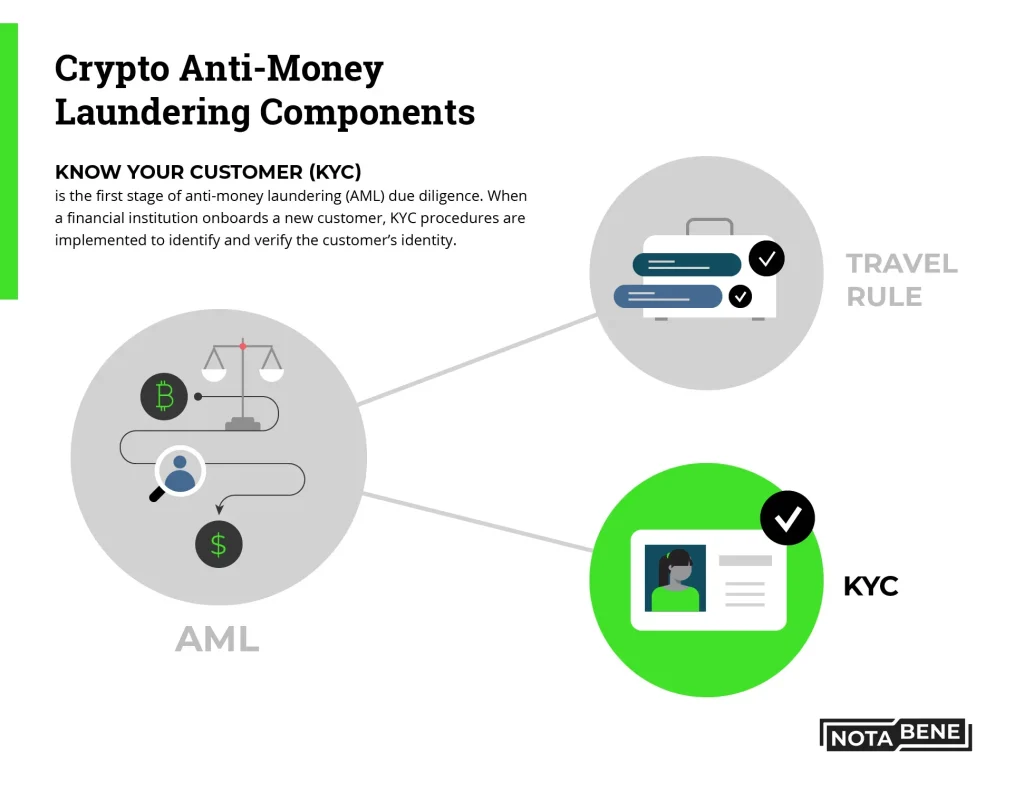

What Is KYC and Why Do Exchanges Require It?

KYC stands for Know Your Customer. It is a regulatory requirement for financial institutions, including cryptocurrency exchanges, to verify the identity of their users. The purpose of KYC is to prevent illegal activities such as money laundering, fraud, and terrorism financing.

Most crypto exchanges, especially those operating in regulated markets, require users to complete KYC verification before they can access full trading features. This verification process usually involves submitting personal information, such as:

- Full name

- Date of birth

- Address

- Government-issued ID

- Selfie verification

However, not all exchanges enforce strict KYC policies. So, does MEXC require KYC? Let’s dive deeper into MEXC’s approach to KYC verification.

Does MEXC Require KYC?

The short answer is no, MEXC does not require KYC for most users. MEXC allows users to create an account, deposit funds, and start trading without mandatory KYC verification. This makes MEXC a more accessible platform for those who prioritize privacy and prefer not to share personal information online.

However, while KYC is optional for basic trading on MEXC, there are certain situations where completing KYC verification might be necessary. These include:

- Withdrawal Limits: Non-KYC users on MEXC have a daily withdrawal limit of 5 BTC. If you want to increase your withdrawal limit, you will need to complete KYC verification.

- Security Enhancements: Completing KYC adds an extra layer of security to your account. It helps protect your funds in case of account recovery or suspicious activity.

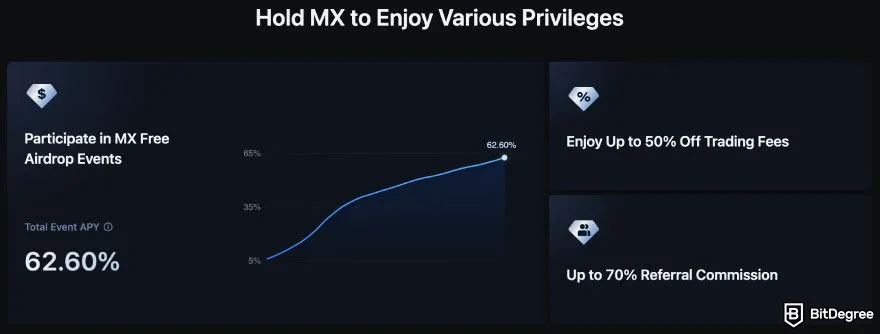

- Participating in Special Events: Some promotional events, airdrops, or token listings on MEXC may require users to complete KYC to participate.

In general, MEXC offers a more flexible approach compared to other exchanges that mandate KYC for all users.

Benefits of Using MEXC Without KYC

Choosing a non-KYC exchange like MEXC has several advantages, especially for users who value privacy and fast account setup. Here are some key benefits:

1. Privacy Protection

One of the main reasons traders prefer non-KYC exchanges is to protect their personal information. KYC verification requires users to submit sensitive documents, which can be a security risk if the exchange is compromised.

MEXC’s optional KYC policy allows users to trade without sharing personal details, giving them more control over their privacy.

2. Quick Registration Process

Without the need for KYC, users can sign up on MEXC within minutes. This makes it convenient for new traders who want to start trading immediately without waiting for verification.

3. Access to a Wide Range of Cryptocurrencies

MEXC offers an extensive selection of cryptocurrencies, including popular coins and new tokens. Users can trade these assets without KYC, making it easier to diversify their portfolio.

4. Lower Fees

MEXC is known for its competitive trading fees. Non-KYC users can enjoy these low fees without any additional charges related to verification.

When Should You Complete KYC on MEXC?

While MEXC does not require KYC for basic trading, there are scenarios where completing KYC verification is beneficial. You should consider completing KYC on MEXC if:

- You need higher withdrawal limits: If your daily withdrawal needs exceed 5 BTC, you will need to verify your identity.

- You want to enhance account security: KYC verification can help secure your account and protect your funds.

- You want to participate in exclusive events: Some token sales, airdrops, and promotions may require KYC verification.

How to Complete KYC on MEXC

If you decide to complete KYC on MEXC, follow these steps:

- Log in to your MEXC account.

- Go to the “User Center” and select “KYC Verification”.

- Submit the required documents:

- Government-issued ID (passport, driver’s license, etc.)

- Proof of address (utility bill, bank statement, etc.)

- Selfie verification

- Wait for approval: The verification process usually takes a few hours to a couple of days, depending on the volume of requests.

How Does MEXC Compare to Other Exchanges?

MEXC’s flexible KYC policy sets it apart from many other popular exchanges. Here’s a quick comparison:

| Exchang | KYC Requirement | Daily Withdrawal Limit (Non-KYC) |

| MEXC | Optional | 5 BTC |

| Binance | Mandatory | 0 BTC |

| KuCoin | Optional | 1 BTC |

| Coinbase | Mandatory | No withdrawals without KYC |

As shown in the table, MEXC provides more freedom compared to exchanges like Binance and Coinbase, which have strict KYC policies.

Is MEXC Safe Without KYC?

One common concern among traders is whether it is safe to use MEXC without KYC. The answer depends on your trading habits and security measures.

MEXC implements robust security features, including two-factor authentication (2FA) and anti-phishing codes, to protect users’ accounts. However, non-KYC users should take additional steps to secure their accounts:

- Enable 2FA for added security.

- Use a strong, unique password.

- Monitor account activity regularly.

Conclusion

So, does MEXC require KYC? The answer is largely no, making it an attractive option for users who value privacy and want a hassle-free trading experience. While KYC is optional for most activities on MEXC, completing it can provide added benefits such as higher withdrawal limits and enhanced security.

MEXC’s flexible KYC policy makes it a standout choice among crypto exchanges, especially for traders looking for anonymity and quick access to the crypto market. Whether you choose to complete KYC or not, MEXC offers a secure and user-friendly platform to meet your trading needs.