Introduction

MEXC is one of the world’s leading cryptocurrency exchanges, known for its extensive list of tradable assets and user-friendly interface. One key feature that stands out on MEXC is the Know Your Customer (KYC) process, a crucial step to ensure security and compliance on the platform. In this article, we will cover everything you need to know about MEXC KYC, why it is essential, how to complete the process, and the benefits of verifying your account.

What is MEXC KYC?

MEXC KYC, or Know Your Customer, is a verification process required by the MEXC exchange to confirm the identity of its users. The KYC process is designed to comply with anti-money laundering (AML) regulations and to protect the platform from illegal activities such as fraud, money laundering, and terrorist financing. By completing MEXC KYC, users can unlock various features on the exchange, including higher withdrawal limits, participation in special promotions, and access to exclusive token sales.

Why is MEXC KYC Important?

The MEXC KYC process is vital for both the platform and its users. Here are some key reasons why it is essential:

1. Security and Fraud Prevention

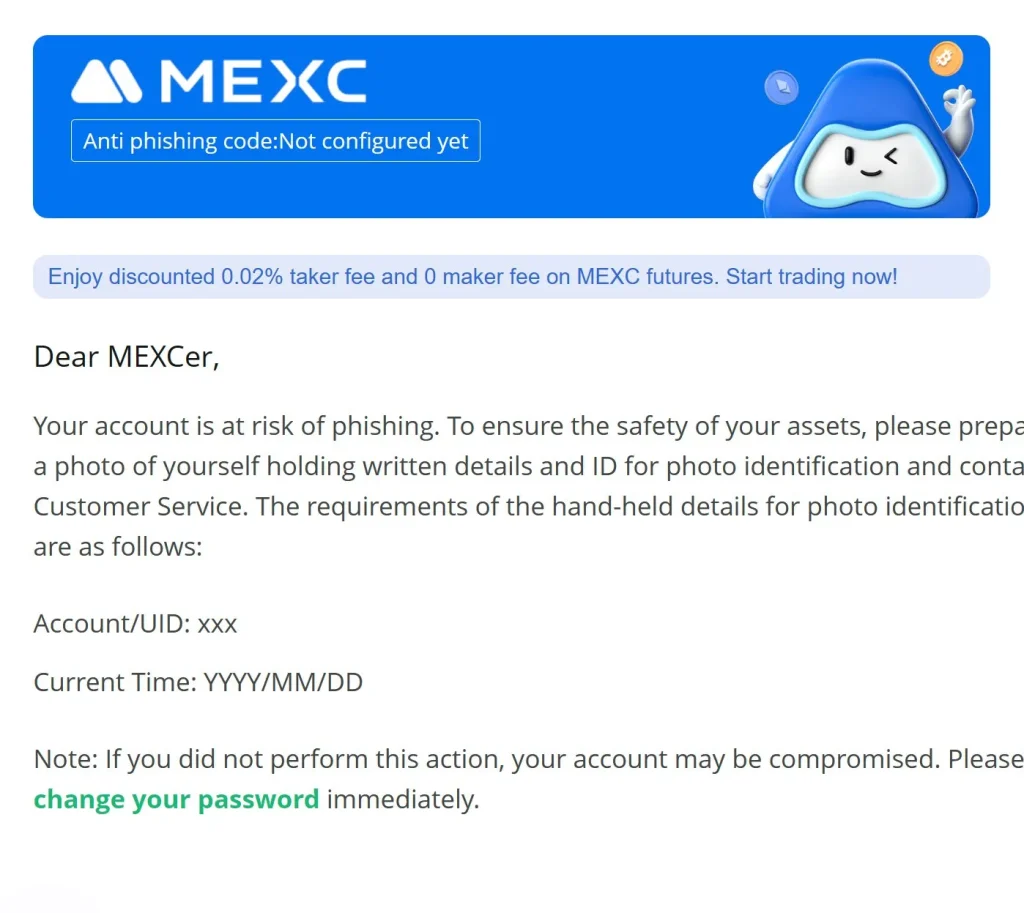

MEXC KYC helps protect users from fraudulent activities. By verifying the identity of users, MEXC can prevent unauthorized access, account theft, and other security threats.

2. Regulatory Compliance

Cryptocurrency exchanges must comply with local and international regulations to operate legally. MEXC KYC ensures that the platform adheres to these rules, providing a safe trading environment for users.

3. Access to Premium Features

Users who complete the MEXC KYC process gain access to premium features such as higher daily withdrawal limits, participation in token sales, and other exclusive benefits.

How to Complete MEXC KYC Step by Step

Completing the MEXC KYC process is straightforward. Follow these steps to verify your account:

Step 1: Log In to Your MEXC Account

Go to the official MEXC website and log in to your account. If you don’t have an account yet, you will need to register first.

Step 2: Navigate to the KYC Verification Page

Once logged in, go to the “Profile” section and select the “Identity Verification” option to start the MEXC KYC process.

Step 3: Provide Your Personal Information

Fill in your personal details, including your full name, date of birth, nationality, and address. Make sure the information matches your government-issued ID.

Step 4: Upload Identification Documents

You will need to upload a government-issued ID such as a passport, driver’s license, or national ID card. Ensure that the document is clear and legible.

Step 5: Complete the Face Verification

MEXC requires users to complete a face verification step. Follow the instructions on the screen to take a selfie or upload a photo that matches your ID.

Step 6: Submit the Application

After providing all the necessary information and documents, submit your application. The verification process typically takes 24-48 hours.

What Documents are Required for MEXC KYC?

To complete the MEXC KYC process, you will need the following documents:

- Government-issued ID: Passport, driver’s license, or national ID card.

- Proof of Address: Utility bill, bank statement, or any document that shows your name and address.

- Selfie for Face Verification: A recent photo matching your ID.

Make sure all documents are valid, clear, and not expired. Incomplete or blurry documents may cause delays in the verification process.

Benefits of Completing MEXC KYC

Completing the MEXC KYC process offers numerous advantages for users:

1. Higher Withdrawal Limits

Verified users can enjoy higher daily and monthly withdrawal limits, making it easier to manage large transactions.

2. Access to Token Sales

MEXC often holds exclusive token sales and promotions that are only available to KYC-verified users.

3. Enhanced Security

KYC verification adds an extra layer of security to your account, protecting your funds and personal information.

4. Improved Customer Support

KYC-verified users receive priority customer support, ensuring faster response times and better assistance.

Common Issues During MEXC KYC Verification

While the MEXC KYC process is generally smooth, users may encounter some issues. Here are common problems and how to solve them:

1. Document Rejection

If your documents are rejected, ensure they are valid, clear, and match the information provided in your profile. Double-check for errors before resubmitting.

2. Face Verification Failure

Face verification may fail due to poor lighting or an unclear photo. Ensure you are in a well-lit environment and follow the instructions carefully.

3. Delayed Approval

The verification process typically takes 24-48 hours. If your application is delayed, contact MEXC customer support for assistance.

Is MEXC KYC Mandatory?

MEXC KYC is not mandatory for all users. However, completing the verification process unlocks many benefits and ensures a more secure trading experience. Non-KYC users have limited access to features, including lower withdrawal limits and restricted participation in promotions.

MEXC KYC vs. Other Exchanges

Compared to other cryptocurrency exchanges, MEXC KYC is relatively straightforward and user-friendly. While some platforms have stricter verification processes, MEXC strikes a balance between security and ease of use.

| Exchange | KYC Requirement | Verification Time |

| MEXC | Optional but Recommended | 24-48 Hours |

| Binance | Mandatory for Full Access | 1-3 Days |

| KuCoin | Optional | 1-2 Days |

| Coinbase | Mandatory | 24 Hours |

Conclusion

MEXC KYC is an essential step for users looking to maximize their experience on the MEXC exchange. By completing the verification process, traders can enjoy higher withdrawal limits, participate in exclusive token sales, and benefit from enhanced security measures. The process is simple, fast, and ensures compliance with global regulations, making MEXC one of the most reliable platforms in the crypto space.

If you’re serious about trading on MEXC, completing the KYC process is a wise decision. Start your MEXC KYC today and unlock the full potential of your trading experience!